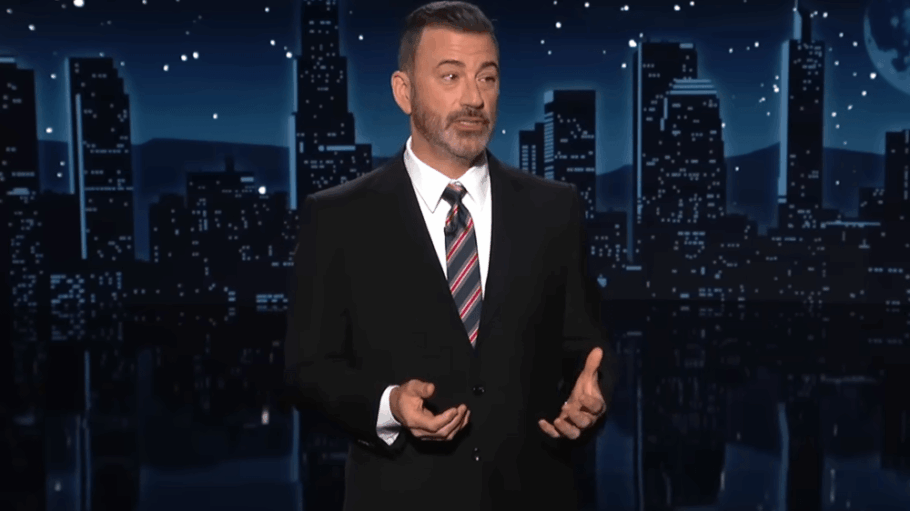

On Tuesday night, viewers in more than 60 U.S. markets couldn’t watch “Jimmy Kimmel Live!” — his first show back after a weeklong suspension by Disney — on their local ABC stations. The Kimmel boycotts by two big TV station groups, Sinclair and Nexstar, clearly drove many fans in those areas to watch his monologue on YouTube, where ABC posted it around midnight ET. It quickly became the show’s most-viewed video on the platform so far in 2025.

Ostensibly, Sinclair and Nexstar are refusing to air “Jimmy Kimmel Live!” in protest of comments Kimmel made last week about Charlie Kirk’s killer. (Sinclair and Nexstar aired news programming on their ABC stations in the late-night timeslot instead.) There’s this much-discussed plotline: FCC chairman Brendan Carr, who wants to promote local TV stations’ efforts to push back on liberal-leaning programming, suggested the agency would pursue investigations into “news distortion” complaints against Kimmel’s show and thereby, in not so many words, cause the FCC to make life difficult for them unless “Jimmy Kimmel Live!” was canceled. Critics cried foul — accusing Carr of attempting to thwart speech that he and the Trump administration don’t like. Nexstar and Sinclair both want to FCC to lift the 39% TV station ownership cap rule, with Nexstar’s $6.2 billion proposed Tegna takeover requiring FCC approval and a change to the ownership cap. Ergo, the obvious conclusion is that those companies want to get in Carr’s good graces.

Whatever the motivations for Sinclair and Nexstar, the question now is: When will they bring back “Kimmel” (if ever) to their stations? And who has more to lose — Disney and ABC, or Sinclair and Nexstar?

On Wednesday, Nexstar said that it is “continuing to evaluate the status of ‘Jimmy Kimmel Live!’ on our ABC-affiliated local television stations, and the show will be preempted while we do so. We are engaged in productive discussions with executives at The Walt Disney Company, with a focus on ensuring the program reflects and respects the diverse interests of the communities we serve.”

For now, it’s unclear how long “Jimmy Kimmel Live!” will be off the air on Sinclair’s 38 ABC affiliates and Nexstar’s 28 ABC stations. Reps for Sinclair did not respond to requests for comment, and Nexstar isn’t saying what might happen beyond Wednesday. A Disney spokesperson declined to comment.

But the financial impact on Disney, Nexstar and Sinclair would be “negligible,” even if the Kimmel blackout by the station groups stretched on for a year, according to Matt Dolgin, senior equity analyst at Wall Street research firm Morningstar.

“Bottom line, Disney would be out only a few million dollars” if the two station groups, which represent about 25% of the U.S. TV audience, preempted “Jimmy Kimmel Live!” for the next 12 months, according to Dolgin. For the media giant ($91.4 billion in revenue for fiscal 2024) it’s barely a rounding error. Dolgin estimates that Nexstar and Sinclair collectively get less than $10 million in ad revenue annually from “Kimmel.”

Love Film & TV?

Get your daily dose of everything happening in music, film and TV in Australia and abroad.

“Disney will be fine either way. For that reason, I don’t expect the station owners will push this too far,” says Dolgin. “Far more important is the relationship between Disney and these station owners, and, to me, Disney holds all the leverage.” The analyst notes that both station groups have affiliate agreements with Disney expiring in 2026, “and it’s critical for the station owners to renew. This is far more important than current monetary impact of preemptions.”

For Disney, what also limits the financial fallout of the Sinclair and Nexstar disputes is that ABC has owned-and-operated stations in four of the five biggest U.S. markets — New York, Los Angeles, Chicago, Dallas-Fort Worth and Philadelphia — with Tegna-owned WFAA serving the DFW market.

Of the ABC affiliates operated by Nexstar and Sinclair, only two are in top 20 U.S. markets: Sinclair’s WJLA in Washington, D.C., and KOMO in Seattle. “We suspect Kimmel’s ratings are lower in the smaller, typically more Republican-leaning markets where Nexstar and Sinclair have ABC affiliates,” Morningstar’s Dolgin says. Nexstar stations affiliated with ABC include KTVX (Salt Lake City), WGNO (New Orleans), WTEN (Albany, N.Y.), WSYR (Syracuse, N.Y.), WKRN (Nashville, Tenn.), WATE (Knoxville, Tenn.), WOTV (Battle Creek, Mich.), WHTM (Harrisburg, Pa.), WRIC (Richmond, Va.), WJGF (Augusta, Ga.), KTKA (Topeka, Kan.) and WTNH (Hartford-New Haven, Conn.). Other Sinclair ABC stations include KDNL (St. Louis), KATV (Little Rock, Ark.), KTUL (Tulsa, Okla.), WTVC (Chattanooga, Tenn.) and WCIV (Charleston, S.C.).

The risk for the station groups that choose to engage in a prolonged blackout of Kimmel’s show “is that people would be ticked off because they would want to see Kimmel, or in the larger sense ticked off because that kind of specific blocking of content speaks to First Amendment rights,” says Prof. Danilo Yanich of the University of Delaware, a professor of public policy and administration whose research focuses on the media industry.

Pushback by viewers in Sinclair and Nexstar’s ABC markets, and the perception that the companies are kowtowing to the FCC chairman’s anti-liberal ideology, could be a factor to lead the companies to relent. “You have an FCC chair who is functioning in a way we’ve never seen before — he is openly partisan, saying the FCC’s function is to support the president’s policies,” Yanich says.

If Disney opts to not renew ABC affiliation deals with Sinclair or Nexstar, that would be “the nuclear option,” Yanich says. A wildcard here is that if the FCC raises or eliminates the 39% ownership cap, that could result in much larger TV stations groups that would have more leverage in talks with Disney. “Consolidation is power. The FCC is poised now to remove broadcast ownership restrictions,” says Yanich.

Disney would take a financial hit if it opted to not renew the ABC affiliation agreements with Nexstar and Sinclair — but it would “face no existential threat,” according to Dolgin. Indeed, if Disney secured no new affiliate deals in those markets, it could still reach the entire U.S. with its content via its streaming services and cable networks. It would be a disruptive action for Disney and ABC to take, upending the way the broadcast TV biz has worked since its inception, and not its preferred option. But traditional TV has been slowly shrinking for years. And Disney could drive more revenue to its streaming services (Hulu, Disney+ and ESPN Unlimited), which could potentially have 100% of ABC programming, helping to offset the “already modest impact” of any loss of linear television, the analyst adds.

In stark contrast, Dolgin says, Nexstar and Sinclair’s sales “are almost completely dependent on broadcast-affiliated linear television programming, so maintaining affiliation is existential.” In 2024, ABC affiliates accounted for 27% of Sinclair’s total advertising revenue. Nexstar doesn’t disclose revenue by network affiliation, but 19% of its “Big Four” affiliations (ABC, CBS, Fox, NBC) are with ABC.

From Variety US