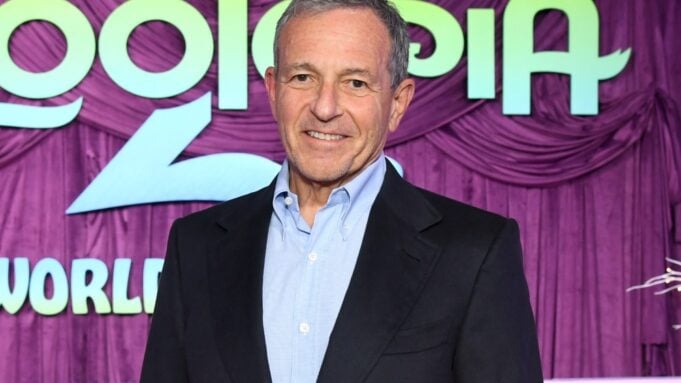

Does Disney CEO Bob Iger favor a Netflix or Paramount Skydance deal with Warner Bros. Discovery?

“We haven’t determined whether we will take a position or not,” Iger said on CNBC’s “Squawk Box” Thursday.

That said, Iger said there were possible regulatory concerns with Netflix’s proposed $83 billion takeover of Warner Bros.’s film and TV studios and HBO Max.

“I think if I were a regulator looking at this combination, I’d look at a few things. First of all, I would look at what the impact is on the consumer,” Iger said. “Will one company end up with pricing leverage that might be considered a negative or damaging to the consumer? And with a significant amount of streaming subscriptions across the world, really, does that ultimately give Netflix pricing leverage over the consumer that it might not necessarily be healthy?”

Iger, again couching his comments as from the perspective of a hypothetical regulator, continued: “Additionally, I’d look at what the impact might be on what I will call the creative community, but also on the ecosystem of television and films, particularly motion pictures. These movie theaters, which obviously run our films worldwide, operate with relatively thin margins. And they require not only volume, but they require interaction with these films and these movie companies that give them the ability to monetize successfully. That’s a very, very important global business. And I think it’s, we have been certainly participating in it in a very big way.”

Disney, in the last 20 years, has had 33 billion-dollar films at the box office, according to Iger. “So we’re mindful of protecting the health of that business. It’s very important to the, what I will call the media ecosystem globally,” he said.

During the interview, CNBC’s David Faber asked whether Iger views Netflix as “a more serious competitor” if it succeeds in closing the deal for Warner Bros. studios and HBO Max. Iger responded, “I’d rather not say anything more than I have said.”

Love Film & TV?

Get your daily dose of everything happening in music, film and TV in Australia and abroad.

Under Netflix’s $82.7 billion deal with Warner Bros. Discovery, announced on Dec. 5, the streaming giant would acquire WB’s studios and HBO Max. On Monday, David Ellison’s Paramount Skydance — after extending six offers for WBD in its entirety over 12 weeks — launched a hostile takeover bid for Warner Bros. Discovery in a bid with an enterprise value of $108 billion.

Iger, about the battle over Warner Bros. Discovery, also commented that “it’s nice to be an observer and not a participant in this.”

The Disney chief recalled that eight years ago, Disney announced a deal with Rupert Murdoch to buy a number of the entertainment assets of 21st Century Fox. Disney closed $71 billion deal for the 21st Century Fox businesses in March 2019.

“We were actually, in many respects, when you look at what’s going on, and we were ahead of the game, so to speak, in that we saw the coming wave of streaming,” Iger said about that deal. “Already, it had begun. And we were going into that business, and we felt we needed not only more volume in terms of content, but more quality, more quality IP, franchises and brands, and also more talent. And so thinking of what the world could become, we jumped on board back then.” Iger added, “we’re certainly glad we have, because now the companies are fully integrated and with it came control of Hulu.”

“So that’s one, in effect, position that we’re taking, is kind of looking at what we did and now looking at what others have determined they must do in order to succeed going forward,” the Disney chief said. “We don’t, so we don’t have skin in the game, so to speak, here.”

Disney now owns 100% of Hulu after Disney finally closed its deal with Comcast to buy out NBCUniversal‘s one-third stake in the streamer in June 2025. Next year, Disney expects to fully merge Hulu into Disney+, eventually winding down Hulu as a stand-alone app and service.

Iger appeared on CNBC alongside OpenAI CEO Sam Altman to talk about Disney’s new three-year licensing deal with the AI giant. Disney is licensing a set of more than 200 characters to OpenAI, which will let Sora generate short, user-prompted “social videos” On Disney+, users will be able to watch curated selections of Sora-generated videos. As part of the deal, Disney will make a $1 billion equity investment in OpenAI.

Disney’s licensing deal with OpenAI does not include name and likeness right, “nor are we including character voices,” Iger said. “And so, in reality, this does not in any way represent a threat to the creators at all, in fact, the opposite. I think it honors them and respects them, in part because there’s a license fee associated with it.” He said that OpenAI is “putting guardrails essentially around how these are used… meaning this will be a safe environment and a safe way for consumers to engage with our characters in a new way.” Iger added, “also, let’s be mindful of the fact that these are 30-second videos.”

Iger also address Disney’s cease-and-desist letter to Google, demanding that Google stop its alleged infringement of Disney IP in its AI systems. Disney was in discussions with Google “basically expressing our concerns,” Iger said. “And ultimately, because we didn’t really make any progress, the conversations didn’t bear fruit, we felt we had no choice but to send them a cease-and-desist [letter].”

From Variety US