In January, Warner Bros. Motion Picture Group chiefs Michael De Luca and Pam Abdy jetted to London to connect with the new crown jewel of the studio, Tom Cruise. The three met to identify a film that would kick off their nonexclusive “strategic partnership.” Sources say a raft of possibilities were discussed, including an “Edge of Tomorrow” follow-up and Quentin Tarantino’s “The Movie Critic,” which currently isn’t set up with a distributor and has Warner Bros., like every major studio, salivating.

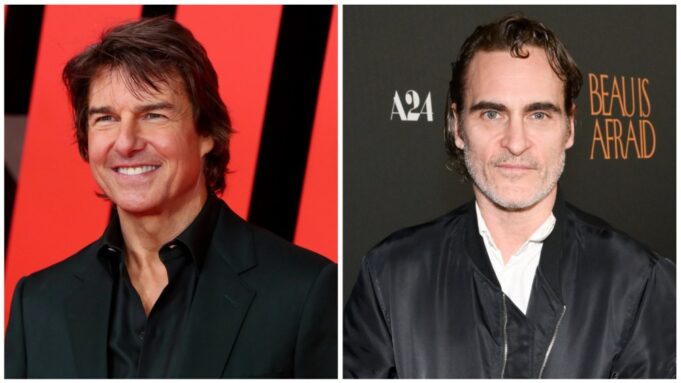

At 61, Cruise remains the king of studio tentpoles, a roost solidified by 2022’s “Top Gun: Maverick,” which took in $1.5 billion worldwide. But Cruise wants more than action stardom — he’d like to return to working with auteurs like Paul Thomas Anderson. In fact, he hasn’t earned an Oscar nomination for acting since he appeared in Anderson’s 1999 drama “Magnolia.” Earlier in his career, Cruise benefited from being directed by heavyweights like Spielberg, Scorsese and Kubrick, but then he he moved into a “Mission: Impossible”-oriented phase where he routinely defies the laws of time and gravity.

In Tarantino, Cruise could find the rare auteur who marries box office performance and awards-season heat. However, securing the project won’t come cheap. The biggest roadblock for De Luca and Abdy is potentially Sony. Sources say Sony Pictures chairman and CEO Tom Rothman has the edge, having distributed Tarantino’s “Once Upon a Time … in Hollywood.”

Still, a Cruise-Tarantino alliance at Warners would align with the De Luca-Abdy modus operandi: Lure A-list directors who can attract bona fide stars — and spend wildly. Since taking over the studio in July 2022, De Luca and Abdy have struck some pricey deals: There’s Anderson’s next movie, which will feature Leonardo DiCaprio (earning $20 million plus), and a Ryan Coogler-Michael B. Jordan vampire film that has Warners ceding the copyright to Coogler after 25 years. The latter move was a head-scratcher considering that Tarantino is the only other director to secure an eventual copyright from a major studio (with “Once Upon a Time”) and will surely be looking to replicate that with “Movie Critic.” But sources who have done recent business with the studio say the mandate to spare no expense to land big talent comes via Warner Bros. Discovery CEO David Zaslav.

“The strategy at Warner Bros. right now and the reason they made some of these big star deals is they’re basically playing with other people’s money,” says one insider. “They’re shopping for Quentin or Cruise with the notion they can use it as a shiny object that is going to be additive when Zaslav sells the company.”

That time may be approaching. In April, Warner Bros. Discovery can entertain offers to buy, sell or merge with a studio like NBCUniversal, as many on the lot believe will happen. That’s when the two-year lock-up period expires as part of the 2022 deal that united WarnerMedia and Discovery. All of the recent moves, from a first-look pact with Margot Robbie’s LuckyChap to the quest to land Christopher Nolan’s “Oppenheimer” follow-up are akin to painting a house before it hits the market.

And this is one splashy renovation. The budget for Todd Phillips’ musical “Joker” sequel — one of De Luca and Abdy’s first green lights — has ballooned to about $200 million, a significant bump from the $60 million cost of the first film. Sources say Joaquin Phoenix is getting $20 million to reprise his role as the clown prince of crime, while Lady Gaga is taking home about $12 million to play Harley Quinn. “Joker” took in more than $1 billion, but musicals are tricky. Case in point: Warners lost $40 million on last year’s “The Color Purple,” according to sources. Though that one can be blamed on the previous regime.

Love Film & TV?

Get your daily dose of everything happening in music, film and TV in Australia and abroad.

Some argue that spending big is essential when releasing movies in theaters.

“There’s only so much top talent in Hollywood, and it’s very competitive and stretched thin because a lot of talent have deals in streaming,” says Jeff Bock of Exhibitor Relations. “If theatrical is going to work, you need the A-lister like Tom and Leo, and Warner Bros. is spending what they need to spend to keep this talent.”

But executives across town believe Warners’ math sometimes doesn’t add up, with the studio decried as fiscally irresponsible. The Anderson film, for instance, was greenlit with a $115 million budget, according to sources. Underscoring the gamble, none of the director’s movies has crossed $80 million at the box office. His latest, 2021’s “Licorice Pizza,” made $33 million worldwide. Even with Cruise’s star power, “Magnolia” only mustered $48.5 million. (It was De Luca, then a New Line exec, who convinced Cruise to play “Magnolia’s” misogynistic self-help guru.) The pair are said to be less pumped about another auteur’s latest: Bong Joon Ho’s “Mickey 17.” In January, Warner Bros. pulled the $150 million Robert Pattinson sci-fi starrer from its schedule and then moved it to 2025. A Warner rep insists: “There is, of course, enthusiasm for it.”

Other projects that De Luca and Abdy prioritized are perplexing executives at rival studios. Warners picked up Maggie Gyllenhaal’s Frankenstein film, which is set in the 1930s and stars Christian Bale and Jessie Buckley. It was a project that Netflix deemed too risky and passed on before Warners salvaged it. (A Warners source says Netflix didn’t want to make it on the timeline Gyllenhaal proposed.)

As merger mania draws near, De Luca and Abdy seem unwilling to push back on talent asks. But apparently they did just that during the Coogler-Jordan negotiations. The director and star wanted 25% of first-dollar gross to split and two guaranteed theatrical release slots for future films. Both deal points were nixed.

Despite the pressure to acquiesce to demands from top talent, De Luca and Abdy can still say no.

From Variety US