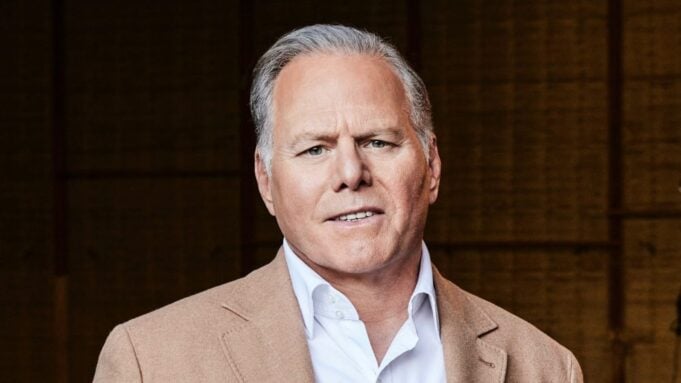

Lawyers for Paramount Skydance sent a letter to Warner Bros. Discovery CEO David Zaslav, expressing “grave concerns” about the alleged unfairness of WBD sales process. The attorneys suggested the Warner Bros. Discovery board has “embarked on a myopic process with a predetermined outcome that favors a single bidder” — meaning Netflix.

The Warner Bros. Discovery board is reviewing second-round bids submitted Dec. 1 from David Ellison’s Paramount Skydance (which is seeking to acquire the entire company in an all-cash deal) and Netflix and Comcast (which are bidding for just Warner Bros. streaming and studios).

“Paramount has a credible basis to believe that the sales process has been tainted by management conflicts, including certain members of management’s potential personal interests in post-transaction roles and compensation as a result of the economic incentives embedded in recent amendments to employment arrangements,” the Dec. 3 letter from Paramount Skydance lawyers to Zaslav said. The Paramount letter also alleged that “It has become increasingly clear, through media reporting and otherwise, that WBD appears to have abandoned the semblance and reality of a fair transaction process, thereby abdicating its duties to stockholders, and embarked on a myopic process with a predetermined outcome that favors a single bidder.”

The Paramount lawyers cited U.S. media reports about “the enthusiasm by WBD management for a transaction with Netflix, and on statements by management that a transaction between WBD and Netflix would be a ‘slam dunk,’ while also referring to Paramount’s bid in a negative light” and that WBD’s “board has really warmed to” a transaction with Netflix due to the “chemistry between” WBD management and Netflix management.

In a reply sent Thursday morning (Dec. 4), Warner Bros. Discovery lawyers wrote to acknowledge receipt of the letter sent on behalf of Paramount Skydance. “We have shared the letter with the members of the Warner Bros. Discovery (‘WBD’) board of directors,” the WBD response letter said. “Please be assured that the WBD Board attends to its fiduciary obligations with the utmost care, and that they have fully and robustly complied with them and will continue to do so.”

Paramount’s letter cited a report by German newspaper Handelsblatt on a meeting that apparently took place in Brussels between Gerhard Zeiler, WBD’s president of international (who, the Paramount lawyers noted, reports directly to Zaslav) with the European Commission’s Henna Virkkunen, EVP of tech sovereignty, security and democracy, to discuss the potential merger prospects for WBD. Zeiler “arrived with a three-person team,” per the Handelsblatt article, and “concerns were raised that the Ellison family’s planned acquisition of Warner Bros. Discovery could lead to excessive media concentration” — and that the European Commission “would consider intervening in a potential merger with Paramount for this reason,” the letter stated. The article quoted “sources close” to Zeiler as saying “that the talks with the Commission were important because both Warner and the EU wanted to preserve media diversity.” Per the Paramount lawyers’ letter to Zaslav, “The implications of such a meeting, if it occurred, are clear and evince a tacit resistance to, if not active sabotage of, a Paramount offer.”

Paramount Skydance’s Ellison previously submitted three bids for WBD but in October the Warner Bros. Discovery board rejected his previous highest offer of $23.50/share, comprising 80% cash and 20% stock. In his previous bids, Ellison had proposed offering WBD chief David Zaslav a co-chairman and co-CEO role in a merged Paramount Skydance-WBD. After WBD commenced the formal M&A review process, Paramount, Comcast and Netflix submitted initial bids Nov. 20, followed by higher offers Dec. 1. The offer prices could not be learned. Paramount’s all-cash offer submitted on Monday included financial backing of three Middle Eastern sovereign wealth funds, Variety reported.

Love Film & TV?

Get your daily dose of everything happening in music, film and TV in Australia and abroad.

Last month, amid the company’s M&A review, the WBD board amended the employment agreements of Zaslav — as well as CFO Gunnar Wiedenfels, chief revenue officer Bruce Campbell and head of streaming and games JB Perrette — to guarantee their stock options will remain valid in the event of a sale of Warner Bros. as a stand-alone entity. WBD’s original separation plan called for the spin-off of Warner Bros. (streaming and studios) as an independent company, with Discovery Global (TV networks) the remaining entity. Under the revised employment agreements, if there’s a “reverse spinoff” — in which Warner Bros. is the remaining entity and Discovery Global gets spun off — the same terms of the employment agreements for Zaslav and the others will apply. In addition, the amendments to the execs’ employment agreements specify that if WBD or Warner Bros. stand-alone enter into a definitive merger agreement before Dec. 31, 2026, Zaslav and the other top brass “will have the same opportunity to vest in, and incentives from, the Signing Options” that they would have received had a separation been completed in 2026, the company said in an SEC filing.

In their letter to Zaslav, the lawyers for Paramount said the company “agreed to certain standstill arrangements in exchange for the opportunity to participate in a truly competitive and unbiased bidding process. Paramount did not bargain for WBD to foster, whether intentionally or unintentionally, a tilted and unfair process.”

The lawyers said they were seeking “confirmation as to whether WBD has appointed an independent special committee of disinterested members of its board to consider the potential transaction opportunities and to make a final determination regarding a sale or break-up of all or part of the company. If not, we strongly urge you to empower such a special committee comprised of directors with no potential appearance of bias or beholdenness to others whose interests may differ from those of the stockholders.”

The Paramount letter concluded, “We remain confident that the Paramount offer would provide the maximum value to WBD stockholders and look forward to the opportunity to continue to engage with you productively in this process. But at this point we must insist on assurances and steps taken to ensure that a truly fair and independent process is being conducted, both for Paramount’s benefit and in the interest of WBD’s stockholders.”

From Variety US