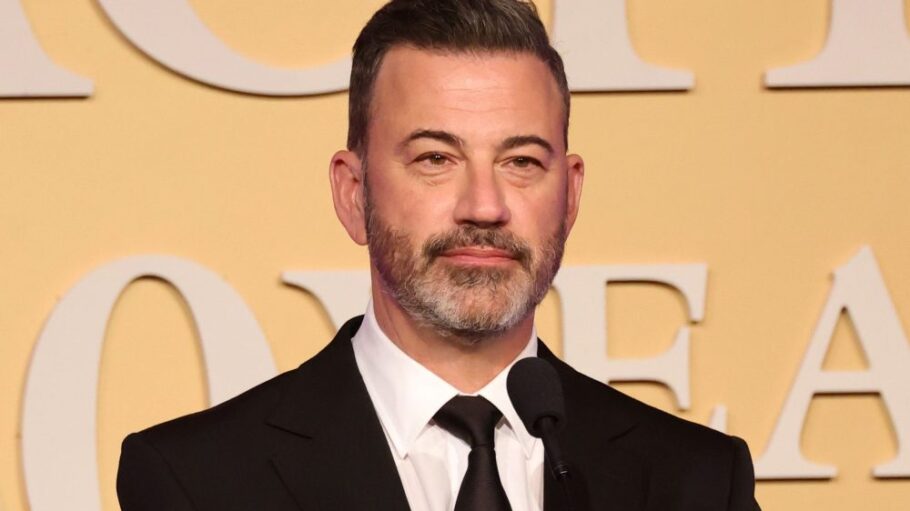

ABC’s decision to suspend Jimmy Kimmel’s late-night show last month drove a surge in cancellations of Disney+ and Hulu streaming services by consumers outraged over the move. However, both services also saw an increase in the number of sign-ups during the month of September, which helped offset those nixing their subscriptions, according to data released Monday.

On Sept. 17, ABC said “Jimmy Kimmel Live!” would be suspended “indefinitely.” That came following remarks the host made on his show two days prior about “the MAGA gang” trying to score political points over the suspect charged with the murder of conservative activist Charlie Kirk, resulting in outrage on the right that led two big ABC affiliate groups — Nexstar and Sinclair — to announce they were pre-empting Kimmel. Disney brought Kimmel back on Tuesday, Sept. 23, with the show delivering TV ratings to rank as its highest-rated episode ever even with the Sinclair and Nexstar boycotts.

A wave of consumers canceled (or threaten to cancel) Hulu and/or Disney+ to protest ABC’s suspension Kimmel. And according to research firm Antenna, for the month of September 2025, the U.S. cancellation rate for Disney+ averaged 8% — double the 4% estimate for the prior two months. Similarly, Hulu’s cancellation rate for the month was 10%, twice the 5% for the preceding two months. For September, the industry weighted average cancellation rate across nine premium services (Apple TV+, Discovery+, Disney+, HBO Max, Hulu, Netflix, Paramount+, Peacock, Starz) was 7%, according to Antenna.

That said, both Disney+ and Hulu had higher sign-ups in September than the two prior months, per Antenna. Disney+ had 2.18 million new subscribers (vs. 1.99 million in August and 1.65 million in July) and Hulu had 2.11 million (vs. 1.97 million and 1.73 million), according to Antenna’s estimates. In addition, the number of gross adds for September of both Disney+ and Hulu saw a market share of 14% each (down compared with August but up vs. July). For the 12-month period from September 2024-September 2025, Disney+ sign-ups averaged 1.99 million and Hulu averaged 2.25 million, per Antenna.

One important caveat: Antenna’s methodology does not cover subscriptions via Disney’s wholesale streaming business, including its distribution deal with Charter. In addition, the Antenna data as released does not shed light on whether consumers who “canceled” did so as part of switching, upgrading or downgrading their streaming plans.

Another note of context about the Antenna data: Disney on Sept. 23 announced price increases across most Disney+, Hulu streaming plans and bundles, and that naturally would have contributed to higher-than-usual cancellations.

In announcing its June quarter results, Disney said it expected total Disney+ and Hulu subscriptions to increase by more than 10 million, primarily driven by the company’s expanded Charter deal — however, that was before the Kimmel brouhaha.

Love Film & TV?

Get your daily dose of everything happening in music, film and TV in Australia and abroad.

It’s not clear what the ultimate result on net additions for Disney+ and Hulu were for the month of September, as that is not a category that is tracked by Antenna. But the increase in sign-ups would obviously have served to mitigate the cancellations the Disney-owned streamers saw for the month.

As of the end of June, core Disney+ subscribers stood at 128 million, up 1.8 million sequentially. Hulu subscribers reached 55.5 million, a net gain of 800,000.

Disney, following in the footsteps of Netflix and others, will stop reporting the number of subscribers for its Disney+, Hulu and ESPN+ streaming services, saying the metric has become “less meaningful to evaluating the performance of our businesses.” The company will discontinue reporting subs and ARPU for Disney+ and Hulu with the first quarter of its fiscal 2026 (the last three months of calendar year 2025), and will no longer report the metrics for ESPN+ as of the September 2025 quarter. The company is scheduled to release September 2025 results on Nov. 13 after the market close.

According to New York-based Antenna, its estimates are based on millions of permission-based, consumer opt-in, raw transaction records, which are sourced from a variety of partners. The data includes digital purchase and cancellation receipts, consumer subscription signals, and credit, debit and banking data. Antenna says it cleans and models the raw data, and then subsequently weighs the panel to correct for demographic and behavioral skews.

From Variety US