When it comes to Apple’s Hollywood ambitions, it’s all about spending big to win big.

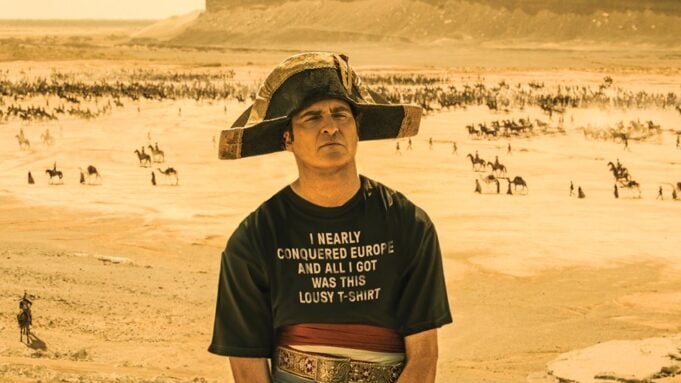

On March 10, the tech giant has 13 shots to take home an Oscar via two historical epics, “Killers of the Flower Moon” and “Napoleon,” which nabbed 10 and three nominations, respectively. That’s given Apple the second-biggest haul among the major studios and streamers, just behind Netflix’s 18 nods and tied with Universal and Searchlight.

But at what price? Sources say the Martin Scorsese-helmed “Killers” cost an eye-popping $215 million (that includes about $40 million in Covid-related costs). In fact, Apple spent at least $700 million to make and market just three films: “Killers,” Ridley Scott’s “Napoleon” and Matthew Vaughn’s “Argylle.” The trio have earned a combined $466 million worldwide at the box office, with “Napoleon” leading the pack at $221 million, followed by “Killers” ($157 million) and “Argylle” ($88 million).

Apple isn’t complaining, at least not about “Killers” or “Napoleon.” A studio source says both films are profitable, buoyed by ancillary revenue streams. Both ranked among the 10 highest-grossing films of the past year on the Apple app store, with “Killers” holding the top spot for four weeks. It’s too early to tell how “Napoleon” is faring on Apple TV+ — it debuted March 1 — but “Killers” is off to a strong start as the most-viewed film on the platform over its first 45 days of release, driving new subscriptions in the process.

Unlike streaming rival Netflix, Apple sees the value of releasing films theatrically to raise their profile. “Killers” and “Napoleon” both enjoyed a 58% peak U.S. awareness score, according to NRG analytics, while “Argylle” had a 45% score. The company’s brain trust believes that making Apple TV+ the exclusive home for high-awareness theatrical movies brings added value for subscribers.

Yet neither “Killers” nor “Napoleon” moved the needle as much as many industry observers expected. “Argylle,” with its $200 million price tag, is an unmitigated disaster. No studio is better poised to absorb colossal budgets than Apple. But even Wall Street is wondering if the studio’s reported $1 billion annual spend on films would have been better served by pumping up the volume of product rather than taking a few nine-figure swings.

“The quality of the films has been extremely impressive and has attracted significant demand for the Apple TV+ service,” says Wedbush Securities’ Dan Ives. “But the Achilles’ heel is not the quality. They just don’t have enough [product]. I think that’s been the tug of war with Apple: They’ve achieved high quality and won Oscars, yet they lack the library in this content arms race.”

Love Film & TV?

Get your daily dose of everything happening in music, film and TV in Australia and abroad.

Since being brought in to launch Apple film and TV operations in 2017, Jamie Erlicht and Zack Van Amburg have employed a brick-by-brick approach to building the studio’s library from scratch.

“There’s clearly an acknowledgment of how important theatrical is — not just in terms of the box office but in terms of the cultural footprint,” says Comscore senior media analyst Paul Dergarabedian. “But it’s unclear what the calculus is for deciding what is appropriate in a movie theater and what should go straight on the Apple platform.”

Apple’s studio business is still in its infancy. But just four years into its Hollywood gambit, the tech titan has reached the pinnacle of awards success, winning the best picture Oscar for “CODA” (a feat Netflix has yet to replicate) as well as 46 Emmys, including for the Michael J. Fox documentary “Still.”

And Apple isn’t alone in spending wildly. According to California Film Commission filings, Netflix splashed out at least $166 million on Zack Snyder’s two-part “Rebel Moon.” But that figure only reflects “qualified” spending, which is defined as below-the-line wages to California workers and payments to in-state vendors and does not include talent deals or marketing. The real cost is likely much higher for two films that certainly won’t match the 10 Oscar nominations “Killers” landed, given the first installment received a frigid shoulder from critics. (“Rebel Moon — Part One: A Child of Fire” has a dismal 21% Fresh rating on Rotten Tomatoes.) Likewise, Amazon spent $75 million for the psychological thriller “Saltburn,” which has earned $21 million worldwide at the box office and was shut out on the Oscar nominations front.

One prominent agent says a course correction on budgets is afoot across the business, including at Apple. “The arms race caused all these people to stupidly overspend, and now they’re starting to retrench,” the agent says.

Apple has already started to diversify its film portfolio. The studio is in production on a Formula One movie starring Brad Pitt and has greenlit the Paul Greengrass thriller “The Lost Bus,” with Matthew McConaughey in the lead. Though the Formula One film will be in the $200 million range, “Lost Bus” won’t be in that stratosphere. More modest bets in the pipeline include the dark comedy “Outcome,” starring Keanu Reeves, Cameron Diaz and Jonah Hill, the latter also co-writing and directing; a Little Richard biopic produced by Ron Howard and Brian Grazer’s Imagine Entertainment; and a documentary about Formula One racer Lewis Hamilton. The Hamilton doc likely will be timed for optimal synergy with the Pitt project in 2025.

Perhaps the biggest question mark surrounds Apple’s approach to putting films in theaters. For its first three wide releases, Apple partnered with a major studio to market and distribute them — Paramount (“Killers”), Sony (“Napoleon”) and Universal (“Argylle”). But the company could simply buy its way to having a full-fledged film marketing and distribution apparatus.

“There’s a lot of pressure for Apple to acquire a major studio,” says Ives. “I still think that it’s more than a 50% chance that they acquire one over the next 12 to 18 months.”

From Variety US