Amazon kept the cash register ringing in the third quarter, including a strong 26% uptick in advertising revenue, turning in results that came in above Wall Street forecasts.

Overall, Amazon reported Q3 revenue of $143.1 billion, up 13%, and net income up more than threefold to $9.88 billion (94 cents per share). The quarter included sales during the first of two sets of Amazon Prime Day deal events, from July 11-12 (followed by the second installment earlier this month). Analyst consensus estimates were for revenue of $141.5 billion and net income of $6.05 billion (59 cents per share), according to FactSet.

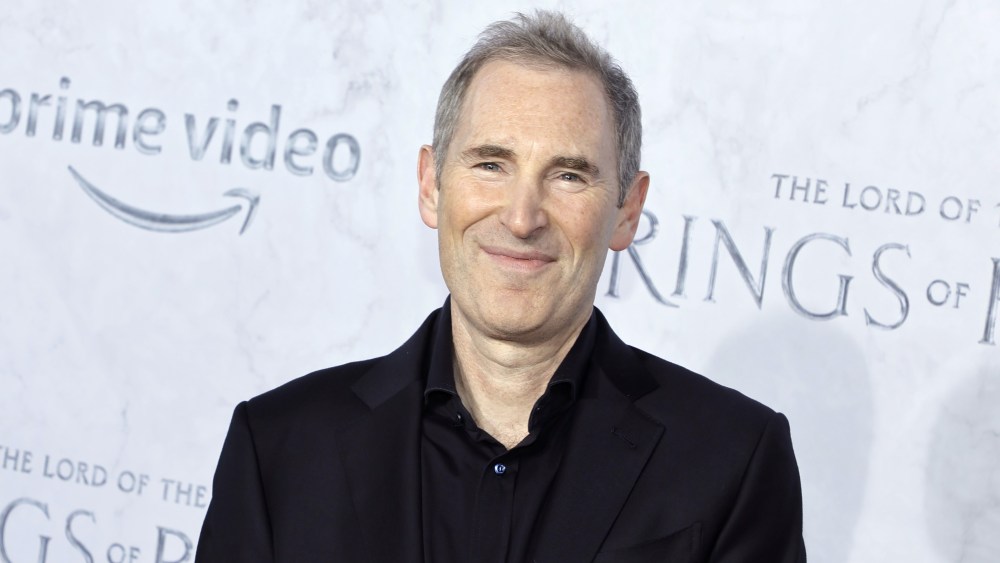

“We had a strong third quarter as our cost to serve and speed of delivery in our Stores business took another step forward, our AWS growth continued to stabilize, our Advertising revenue grew robustly, and overall operating income and free cash flow rose significantly,” Amazon CEO Andy Jassy said in announcing the results.

On the Q3 earnings call, Jassy touted Prime Video as an “integral” component of the Prime membership program that is often one of the top two reasons people sign up. He also said Amazon sees Prime Video eventually becoming a “large and profitable business in its own right.”

Amazon’s ad revenue for Q3 was $12.06 billion, an increase of 26%, continuing the tech giant’s market share grab in the digital-advertising space. Analysts had forecast ad revenue hitting $11.6 billion. The segment includes sales of advertising services to sellers, vendors, publishers, authors and other third parties, through programs such as sponsored ads, display ads and video advertising. That includes ads sold for Prime Video’s exclusive “Thursday Night Football” games package and the Freevee ad-supported video service.

The company touted the performance of “Thursday Night Football” on Prime Video, which through the first six games in the 2023 NFL season has averaged 12.9 million viewers, an increase of 25% from last season’s six-game average, according to Nielsen. Season to date, the median age for “TNF” viewers is 47 — seven years younger than the median age watching the NFL on linear networks.

On the advertising front, Amazon said during Q3 it partnered with BuzzFeed, Hearst Newspapers, Pinterest, Raptive, Ziff Davis’ Lifehacker and Mashable, and others to display sponsored product ads on their apps and websites for products sold in Amazon’s U.S. store.

And Amazon will soon even more ad inventory to sell: Starting in 2024, the company’s Prime Video service will begin running ad breaks in programming, although it will serve “meaningfully fewer ads” than traditional TV networks, Jassy said on the earnings call. To continue watching Prime Video without ads, customers will need to pay an extra $2.99 per month in the U.S., in addition to the cost of Prime membership ($139/year).

Meanwhile, revenue in the Amazon Web Services (AWS) cloud-computing division was up 12%, to $23.06 billion, and operating income was $6.98 billion, up 29% compared with operating income of $5.40 billion in third quarter 2022.

Also during the quarter, Amazon announced the Fire TV Stick 4K Max, which comes with the Fire TV Ambient Experience that “turns the TV into an always-smart display” to do things like show calendars, control smart devices or play audio. It also introduced the Fire TV Stick 4K with support for Wi-Fi 6, and the Fire TV Soundbar with support for DTS Virtual:X and Dolby Audio.

From Variety US