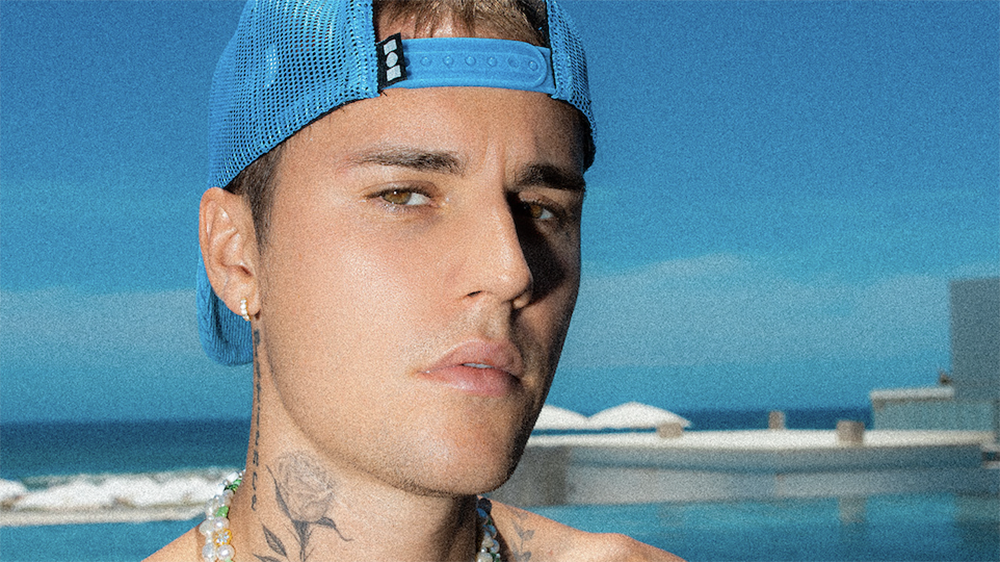

As expected, Justin Bieber has sold his music rights to Blackstone-backed Hipgnosis Songs Capital for north of $200 million, the company has announced. News of the impending deal, which had been rumored for weeks, was widely reported last month.

The deal includes Bieber’s shares of his publishing and recorded-music catalog, Bieber’s interest in his publishing copyrights (including the writer’s share of performance), master recordings and neighboring rights for his entire back catalogue, comprising over 290 titles released before December 31, 2021. Sources tell Variety that Bieber’s songs will continue to be administered by Universal Music, the singer’s longtime home. His master recordings will continue to be owned by UMG in perpetuity.

The acquisition has been made on behalf of Hipgnosis Songs Capital, a partnership between Hipgnosis Song Management and funds managed by Blackstone. Bieber was represented by Scooter Braun at Hybe America, David Bolno at NKSFB, Aaron Rosenberg and Audrey Benoualid at Myman Greenspan Fox Rosenberg Mobasser Younger & Light LLP and Michael Rhodes at Cooley.

Braun, CEO of Hybe America and Bieber’s manager of 15 years, said: “I want to thank Merck and his entire Hipgnosis team and all of our partners involved for working so hard to make this historic deal happen. When Justin made the decision to make a catalog deal, we quickly found the best partner to preserve and grow this amazing legacy was Merck and Hipgnosis. For 15 years I have been grateful to witness this journey and today I am happy for all those involved. Justin’s greatness is just beginning.”

Merck Mercuriadis, founder and CEO of Hipgnosis Song Management, said: “The impact of Justin Bieber on global culture over the last 14 years has truly been remarkable. This acquisition ranks among the biggest deals ever made for an artist under the age of 70, such is the power of this incredible catalog that has almost 82 million monthly listeners and over 30 billion streams on Spotify alone. Scooter Braun has helped him build a magnificent catalog, and it’s a pleasure to welcome Justin and his incredible songs and recordings to the Hipgnosis family.”

Hipgnosis Songs Capital was represented by William Leibowitz at William R. Leibowitz Law Group, Seth Traxler and Rory Wellever at Kirkland & Ellis LLP and Robert Fowler & Lisa Ong at HW Fisher.

The news arrives during a quiet time for the singer, just weeks after he postponed the remaining dates in his “Justice” tour until an unspecified time “next year.” The tour, which was originally scheduled to launch in 2020, has been postponed or delayed several times, initially due to the pandemic but most recently following his bout with Ramsay Hunt syndrome, a rare virus that in his case caused facial paralysis. It finally launched in March and covered most of North America, but he postponed the remaining dates early in June after announcing his difficulties with the disease.

Love Film & TV?

Get your daily dose of everything happening in music, film and TV in Australia and abroad.

It also comes amid a general cooling-off of the formerly red-hot catalog market, which has become less attractive as asking prices have soared and interest rates and capital gains taxes have risen.

Bieber’s catalog, while containing shares of his multiple hits over the past 15-odd years, is also less of a proven quantity than more seasoned catalogs, such as Genesis and Phil Collins, whose catalogs were sold for a reported $300 million earlier this year.

However, some companies, particularly Hipgnosis, have embraced newer catalogs. According to the Journal, the Bieber deal would be the largest music-rights acquisition for Hipgnosis to date. Earlier this year, the company acquired the song-catalog rights of Justin Timberlake, whose works are a few years older than Bieber’s, in a deal reported to be worth just over $100 million. While Bieber’s share of hits like “Sorry,” “Love Yourself” and even older tracks like “Baby” is said to be relatively small, they are still massive global hits that for many define an era. Conversely, Hipgnosis also acquired the catalog of legendary singer-songwriter Leonard Cohen, which includes many classics that are more than 50 years old.

From Variety US