As Hollywood heads to Las Vegas for CinemaCon, studios will land in Sin City with a renewed appreciation for the money that can be made in cinemas.

After experimenting with different release strategies and launching their own streaming services, many studios better understand that there’s no substitute for the attention and treasure that comes with a big, old-fashioned theatrical launch. Bold moves like Warner Bros.’ decision to send its entire 2021 slate to HBO Max at the same time the films opened in cinemas proved to be a mixed bag, and every major studio has opted to have some kind of exclusive theatrical window for the foreseeable future.

That means that the palpable tension that hung over last year’s gathering will have lifted, even as the box office has failed to recapture its pre-pandemic stride. But there are plenty of unpleasant realities still facing an exhibition industry hoping to move on from COVID. As CinemaCon kicks off on Monday, here are five burning questions facing the movie theater business.

Are movies making money?

It’s a caveat that accompanies the box office reporting on even the biggest hits of the past two years, with sages noting that such and such a gross is a strong result “for a pandemic.” Those words are a grim acknowledgment that with the possible exception of “Spider-Man: No Way Home” ($1.9 billion globally, baby), most of the would-be blockbusters that have debuted since COVID hit the scene have failed to perform at the box office in the same way that they would have before the virus disrupted things. That’s partly due to the fact that older audiences remain skittish about returning to cinemas and have yet to come back in force. It also means that while franchise films like the 007 entry “No Time to Die” and “F9: The Fast Saga” were among the highest-grossing movies of 2021, they made significantly less money than previous chapters in their series. In fact, they likely failed to turn a profit when marketing expenses are taken into account. That’s a problem considering that the cost of making movies has only increased during COVID thanks to rigorous safety precautions, frequent testing and the inevitable delays or shutdowns that have befallen nearly every major film. Studio insiders say that all of these factors have added between 7% to 15% to the budgets of almost every movie that they have shot since production resumed in 2020. If you’re spending more money to make less, that’s not a fantastic business model. It may lead to studios demanding a higher split of ticket sales from exhibitors… or force them to cut back on the number of films that they make for theatrical release. At some point, things just don’t add up.

Will geopolitical tensions hurt Hollywood?

The answer is yes, yes, yes. Even before major swaths of the country went back into lockdown, China had soured on Hollywood movies. They barred major releases like “Black Widow” or “Spider-Man: No Way Home” from entering the country or consigned them to unfavorable release dates where they struggled to attract crowds. At the same time, China’s domestic offerings have surged in popularity, with films like “Water Gate Bridge,” “The Battle at Lake Changjin” and “Hi, Mom” pulling in massive ticket sales. With relations between the Chinese and U.S. government at a nadir, China seems unlikely to allow more foreign movies to show on its screens, which deprives Hollywood fare of access to the world’s largest market for film and with it hundreds of millions of dollars in potential revenue.

Love Film & TV?

Get your daily dose of everything happening in music, film and TV in Australia and abroad.

Then there’s Russia, which was the sixth-highest grossing movie market in 2021. Since the country invaded Ukraine and sanctions went into effect, Hollywood studios have written off the country and publicly stated that they won’t release movies there. In truth, they didn’t have much choice. After the U.S., Canada and Europe banned Russian banks from using SWIFT, a global messaging system that facilitates banking transactions, studios wouldn’t have been able to get any money that they earned out of the country any way. But with two of the highest-grossing international markets all but shut off, Hollywood movies will no longer be able to rely on overseas revenues to consistently pad their bottom lines and lift their films into profitability.

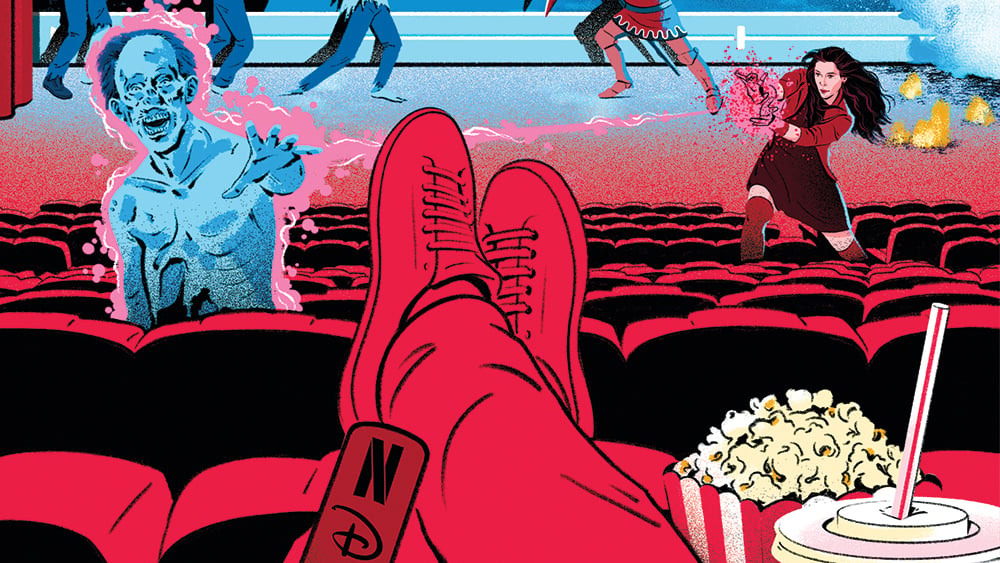

Do audiences want to watch anything other than comic book movies?

“The Batman” ($754 million globally to date) may be the highest grossing movie of the year so far, but there are plenty of promising signs that moviegoers want to watch more than just Spandex-wearing vigilantes on the big screen. Sandra Bullock and Channing Tatum’s romantic comedy “The Lost City,” A24’s multiverse adventure “Everything Everywhere All at Once” and Tatum’s road trip two-hander “Dog” (it’s been a good year for the “Magic Mike” star) are a few of the recent box office success stories that do not involve masked heroes. Marvel movies aren’t going anywhere (expect “Doctor Strange in the Multiverse of Madness,” “Thor: Love and Thunder” and “Black Panther: Wakanda Forever” to rank among 2022’s biggest earners). But box office prognosticators also have high hopes for films like Jordan Peele’s next nightmare “Nope,” Olivia Wilde’s starry mind-bender “Don’t Worry Darling” and David Leitch’s assassin thriller “Bullet Train.”

A new study backs up that notion. The movie ticketing service Fandango recently polled 6,000 ticket buyers, and 93% of those surveyed indicated they wanted to see films in multiple genres, not just comic book movies.

From those consumers’ lips to Hollywood’s ears. With all due respect to Peter Parker and his compatriots, maybe it’s time to let other protagonists try their hand at saving the box office.

Will theater owners make nice with streamers?

Crazier things have happened. Netflix was once the enemy of exhibition because the streaming service would not comply with the industry-standard 90-day theatrical window. But that was then, and this is now. Theater operators need no reminder that COVID-19 took a sledgehammer to their long-standing agreement with studios to keep movies in theaters for roughly three months before bringing them to the home. Now, major studios have converged around a leaner 45-day window (with the exception of Universal, which established its own 17-day period for smaller titles and 30-day frame for blockbusters). That means AMC, Regal, Cinemark and other onetime Netflix opposers can’t exactly complain that Netflix is putting its films on streaming too early if they’re allowing Warner Bros., Universal and Disney to do the same.

In a recent Variety interview, Imax CEO Richard Gelfond did not dismiss the idea of allocating a couple of its premium screens to the streamer. “The world is changing rapidly. I suspect our exhibition partners are going to be more flexible. I think Netflix will be more flexible. With time, you will see some of their more special movies coming out in Imax,” Gelfond says.

And in the event that studios start to release fewer movies each year, companies like Netflix, Apple and Amazon could become invaluable to content-hungry theater operators. Hollywood loves a twist-ending, right?

How many screens will be lost in the wake of the pandemic?

The past two years has left many cinema owners dangling on a knife’s edge, but most have managed to keep from falling off, with only 2% of U.S. screens closing since the onset of COVID-19. That’s a small miracle, since movie theaters had to withstand prolonged cinema closures followed by an endless wave of release date delays. But there have been some notable casualties, such as Arclight Hollywood and Regal UA Court Street in Brooklyn, as well as many beloved arthouse locations. AMC and Alamo Drafthouse were forced to shed some underperforming locations to lighten debt loads, but both chains have since bounced back and even snatched up new venues in the U.S.

However, there could be more closures looming — especially if domestic box office grosses do not return to pre-pandemic levels sometime soon. Barry Diller, who once ran Paramount and Fox, has predicted that only 10% of traditional movie theaters will survive as streaming services become a bigger and bigger priority. (It should be noted that pandemic or not, Diller has long been beating the drum on Hollywood’s demise.) But if the lingering virus has proven one thing to the film business, movie theaters do not plan to go down without a fight.

From Variety US